What do you mean I have to buy back half my business?

It’s hardly surprising that all business owners struggle with the notion of how long we will be in business.

It can be an even greater struggle thinking we might actually be forced to retire from being in business.

Read in this article

- When the never-ending story, comes to an end

- Splitting a single valuable asset between multiple people

- When one owner leaves a multi-owner business partnership

- What happens when you only own half the pie?

- How to split the share of a business with another

- The process is referred to as establishing a Buy-Sell arrangement

- The two parts of a Buy-Sell agreement

When the never-ending story, comes to an end

When we first start out in small business, business seems quite endless. Then midway through, as experience builds and growing pains set in, it seems to lag. Then only after we have finally professionalised our processes and reached the peak earning time of life, it seems there is just never enough time left to achieve the wealth we really want to.

Midlife is the time where you lose the illusion of immortality. You know your opportunities aren’t endless, and you realize that time is finite.

Splitting a single valuable asset between multiple people

Owning something valuable with another person, like a business, brings with it unusual problems in the future when one of the owners may need to sell their share of that valuable item.

Whether that's a house, a rare artwork, or an ongoing business with complex ownerships, debt issues, tax liabilities, and invested funds - agreeing on what is a fair asset valuation can be difficult, especially when these decisions are avoided today, and left to a future stressful time.

When one owner leaves a multi-owner business partnership

For small business owners and their families, there is a lot riding on the ongoing stability of their business; growing its value and ultimately getting back the money it owes them, through its successful sale to another person.

- But what if the business is already partially owned by another?

- How would this co-ownership of a business affect the owner's future plans and hope for financial stability?

- What are the unique risks of being in business with another person?

What happens when you only own half the pie?

Ask yourself these three questions.

- If your business partner had to leave the business this week, how would you afford to buy out their share of the business?

- What would happen if they decided to sell their share to a competitor?

- What would happen to the business if their share was inherited by their family members who just wanted to sell off business assets and use the business account as their new spending account?

Most small businesses evolve without much future planning, so it's not surprising that thinking about what would happen if a business partner was no longer able to continue in the business in the future, is not a regular topic of conversation.

We will all leave our business sometime in the future (we just don't know when or how). The uncomfortable reality many business owners avoid thinking about is we will all leave our businesses sometime in the future - whether that's by choice or by circumstances.

Leaving your Business by Choice

- We may reach a level of success and want to sell up and move on.

- We may find another business more interesting and want to pivot.

Leaving your Business by Circumstances

- Like 1 in 5 Australians, you may face a surprise change in our health, suffer a sickness or injury or face disability and be forced to leave your business.

- You may also be forced to exit a business because you cannot afford to buy out a business partner for their share of the business, should these things happen to them.

Choice and surprise circumstances could put at risk everything you have built so far.

How to split the share of a business with another

These are the two main questions all business partners will face in the future unless they make a simple decision today and agree ahead of time on two key issues;

- How the business will be valued (and therefore what is the sale price), and

- How an owner's interest will transfer to the remaining owners.

These are the two questions a Buy-and-Sell Agreement can fix ahead of time.

Pro Tip: This process is especially important for Partnerships Partnerships and Multi Owner Businesses.

The process is referred to as establishing a Buy-Sell arrangement

Problems associated with business partners suffering a sickness, injury or unexpected death (as well as disputes between partners), can all lead to the destruction of the business but can be simply prevented by making a Buy-Sell agreement between the business owners and partners. Once agreed to by all parties, documented and signed, the agreement becomes legally recorded in a hard document.

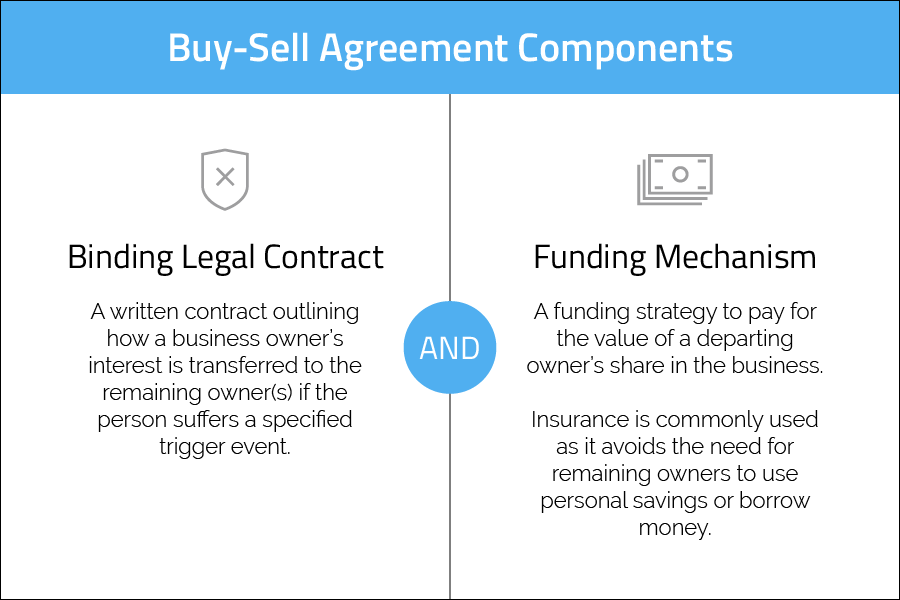

The two parts of a Buy-Sell agreement

There are two parts to a Buy-Sell agreement.

- A Legal document, and

- A Funding mechanism

The Legal document

The first part, the buy-sell agreement, is a written contract outlining how a business owner’s interest is transferred to the remaining owner(s) if the person suffers a specified trigger event.

- Specified Trigger Events could include death, serious illness or injury, permanent disability, retirement or resignation.

The Buy-Sell agreement can be drafted by a lawyer to meet any specific needs and the business structure and typically includes:

- Whether a sick or injured partner can still draw an income from the business, and for how long?

- What method of business valuation will be used if one owner’s share of the business needs to be sold?

- The list of specific trigger events to be covered, and

- The process to follow if the agreement is triggered.

Having this agreement in place can help to avoid future disputes. The departing owner (or their beneficiaries/estate) will receive an agreed value for their share of the business and the remaining owner(s) are able to continue to run the business the way they want to.

The Funding mechanism

The second part is how to pay for the departing owner’s business share.

- Life & Disability Insurance is commonly used as it avoids the need for remaining owners to use personal savings or borrow money.

- Insurance can only be used to cover trigger events such as death, total and permanent disability or serious illness or injury that also meets the terms of the insurance policy.

- Other funding options (such as savings, loans or deferred purchase agreements to make payments over a number of years) need to be considered for any trigger events in the agreement that are not covered by the insurance; for example retirement or resignation.

Warning: Without a written Buy and Sell Agreement, you can be caught in business with your former partner's spouse.

Suddenly inheriting a business with no Buy & Sell agreement | Lynn's Story

Bill and Alex each owned 50% of the shares in a successful building maintenance business with an established client base, with typically 3-year recurring contracts and good retainer income. Sadly Bill recently died due to complications from a skin melanoma on his face.

- Bill’s shares in the company were immediately inherited by his wife Lynn, via his Will.

- Because there was no Buy-Sell agreement in place, Lynn is not legally obliged to sell the shares in the business to the remaining owner Alex, and Alex is not obliged to buy the shares from Lynn, the new co-owner.

To make things more difficult:

- There was no agreed price or timeframe for the transfer of Bill’s shares in the company.

- There was no insurance in place as a funding mechanism to enable Alex to buy the shares, and

- Alex doesn’t have enough private funds to buy out Lynn nor does he have the capacity to borrow the money, to buy Lynn's shares of the business.

To further complicate matters, Lynn is immediately entitled to the same management rights and share of company profits as her deceased husband, while Alex is doing 100% of the work but only receiving 50% of the profits.

- Both survivors now feel vulnerable and uncertain about their futures.

This outcome could have been avoided if Bill and Alex had sought financial advice from Sapience, and established a Buy-Sell agreement, funded by insurance. By using this strategy, Lynn would have received the insurance proceeds in exchange for handing over her interest in the business to Alex. As a result, Lynn would have been fully compensated, while Alex would have taken ownership of 100% of the business and received 100% of the profits.

Without this strategy in place, the future for Alex and Lynn is becoming volatile.

Sapience works with accountants and solicitors to provide the insurance advice needed and we regularly check in with our clients to review changes in the business valuation where insurance needs to be adjusted.

If you haven't got your business ownership transfer arrangements in place, documented and legal, it's time to make that call to us today and get it sorted.

Call us today on 1300 137 403 or email us here for a no-obligation private chat about your situation.

Drew Browne is a specialty Financial Risk Advisor working with Small Business Owners & their Families, Dual Income Professional Couples, and diverse families. He's an award-winning writer, speaker, financial adviser and business strategy mentor. His business Sapience Financial Group is committed to using business solutions for good in the community. In 2015 he was certified as a B Corp., and in 2017 was recognised in the inaugural Australian National Businesses of Tomorrow Awards. Today he advises Small Business Owners and their families, on how to protect themselves, from their businesses. He writes for successful Small Business Owners and Industry publications. You can read his Modern Small Business Leadership Blog here. You can connect with him on LinkedIn. Any information provided is general advice only and we have not considered your personal circumstances. Before making any decision on the basis of this advice you should consider if the advice is appropriate for you based on your particular circumstance.

Drew Browne is a specialty Financial Risk Advisor working with Small Business Owners & their Families, Dual Income Professional Couples, and diverse families. He's an award-winning writer, speaker, financial adviser and business strategy mentor. His business Sapience Financial Group is committed to using business solutions for good in the community. In 2015 he was certified as a B Corp., and in 2017 was recognised in the inaugural Australian National Businesses of Tomorrow Awards. Today he advises Small Business Owners and their families, on how to protect themselves, from their businesses. He writes for successful Small Business Owners and Industry publications. You can read his Modern Small Business Leadership Blog here. You can connect with him on LinkedIn. Any information provided is general advice only and we have not considered your personal circumstances. Before making any decision on the basis of this advice you should consider if the advice is appropriate for you based on your particular circumstance.